Whether saving short-term for things like a small home renovation, new car, or staycation, or long-term for retirement, travel, or a new home, your future depends on the decisions you make today.

Dream big with your goals and achieve them with one of Access Credit Union's tailored investment solutions and wealth management options.

Investment Options to reach your financial goals

Registered Retirement Savings Plans

Build a retirement plan and start saving for sandcastles and sunshine. With an RRSP, you can enjoy deferred tax on your income and the flexibility of multiple investing options.

Tax-Free Savings Accounts

It’s never too late to start saving. Just like it’s never too late to start that masterpiece. A TFSA is a great place to begin and you’ll enjoy the benefit of having your interest earned tax-free!

Registered Education Savings Plans

Start saving for your child’s future by investing in an RESP. Find future comfort and security with deferred tax on your income and guaranteed interest.

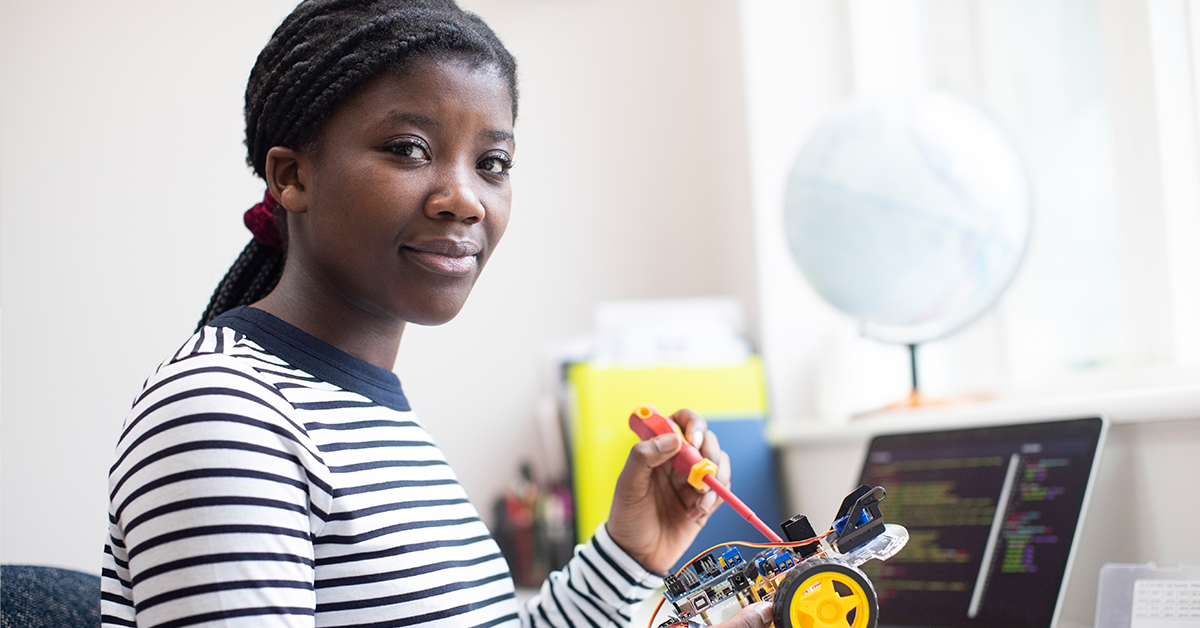

Why Invest with Access Credit Union?

Earn profit with Member Rewards.

Access members are true owners of the organization and are eligible to share in the annual profits through our Member Rewards program

Wealth management made for you.

We help you create a personalized wealth strategy to map out your long-term plan to inform and guide important financial decisions.

Term Deposits

Save for the life you deserve and the comfort you need with guaranteed interest and peace of mind.

Featured Rates

Financial advice from our experts

Get the knowledge you need to control your finances with our Uncomplicated Advice.

What is an RRSP and why should you have one?

An RRSP is Canada’s most popular retirement savings product for a reason. Find out why!

The truth about TFSAs (and why you should open an account today)

A TFSA is an extremely helpful savings product, but one that comes with many questions.

Why an RESP is great for education savings

When it comes to saving for a post-secondary education, it’s hard to go wrong with an RESP.