First Home Savings Account (FHSA)

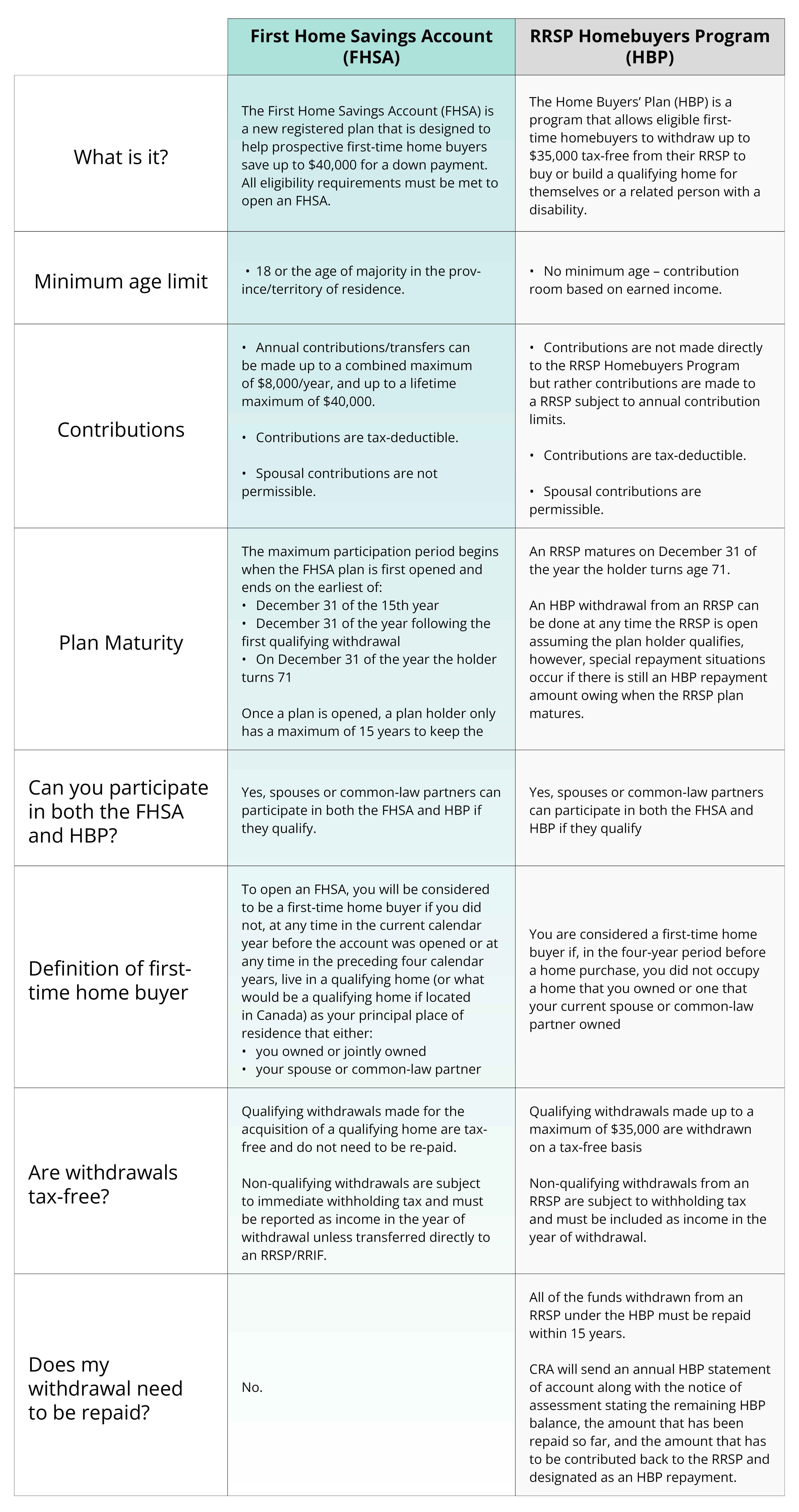

A First Home Savings Account (FHSA) is a new registered plan that gives prospective first-time homebuyers the ability to save up to $40,000 for a down payment on a tax-free basis.

The earnings in this type of plan are tax-sheltered and you can have more than one FHSA*.

* Subject to the FHSA participation room and lifetime FHSA limits. The maximum participation period starts when the first FHSA is opened.

Features of a FHSA

Lower taxable income

Contributions are tax-deductible and you can contribute or transfer up to $8,000 per year from your RRSP. This allows your savings to grow tax-free!

Tax-Free withdrawals

Withdrawals used to purchase a qualifying home are non-taxable and no repayment is required for withdrawal for your home purchase.

Carry forward any unused contribution room

Carry forward unused portions of your FHSA participation room up to a maximum of $8,000. Unused funds can also be transferred to an RRSP or RRIF.

Note: Members must have online banking to view FHSA transactions.

Current Rates

1-Year Fixed

GIC/Registered Plans

3.40%

5-Year Fixed

GIC/Registered Plans

3.75%

*Rates subject to change without notice.

Frequently Asked Questions

To open an FHSA, you need to:

- Be at least 18 years of age but less than 72

- Be a resident of Canada and hold a valid SIN

- Be a first-time home buyer

If you do not meet the eligibility requirements and an FHSA is opened, any withdrawals will be subject to a withholding tax and your contributions will not be tax deductible.

The participation period begins when the accountholder opens their first FHSA and ends on the earliest of:

- December 31 of the 15th anniversary of the date the holder opened their first FHSA;

- December 31 of the year the holder turns 71; or

- December 31 of the year following the holder's first qualifying withdrawal.

Funds remaining at the end of the maximum participation period must be transferred to an RRSP/RRIF or withdrawn on a taxable basis.

Opening an FHSA before December 31, 2024, means you gain the $8,000 contribution room for the 2024 tax year. You don't need to deposit funds into the account until you are ready, as you can carry forward the contribution room.

If you don’t open an FHSA in 2024, you won’t start to accrue contribution room until 2025. The maximum amount you’ll be able to contribute in 2025 is limited to the annual contribution/transfer amount of $8,000 instead of $16,000. This means it will take longer to reach the maximum participation amount of $40,000.

There are several ways to deposit funds into an FHSA:

- Make a cash deposit from your chequing or savings account.

This option provides you with a tax deduction.

- Transfer funds from an RRSP.

This option does not reinstate contribution room to your RRSP and does not provide you with a tax deduction; but if withdrawn for qualifying home purchase, does not need to be repaid.

- Withdraw funds from a TFSA into a chequing or savings account, then make a cash deposit into your FHSA.

The amount withdrawn from your TFSA will be reinstated the following year and you will get the tax deduction associated with the cash deposit. You can’t transfer directly from a TFSA to an FHSA.

If you want to claim the tax deduction for the 2024 tax year, you will need to deposit funds into your FHSA before December 31, 2024. If you don’t deposit funds into your FHSA account before December 31, 2024, you can carry forward the contribution room ($8,000 per year), but you won’t be able to claim the tax deduction for the 2024 tax year.

You can’t claim funds transferred from an RRSP as a deduction.

If at any time in the current calendar year before the account was opened or at any time in the preceding four calendar years, you lived in a qualifying home outside of Canada that you owned, you would not qualify for an FHSA.

You have a lifetime limit of $40,000. If you withdraw $15,000 for a qualifying withdrawal, you do not regain $15,000 the following year.

At this time, you are unable to make contributions and withdrawals online. Visit your local branch or contact the Member Solutions Centre at 1.800.264.2926 for assistance.

If you do not meet the eligibility requirements and an FHSA is opened, any withdrawals will be subject to a withholding tax and your contributions will not be tax deductible.

Please review the eligibility requirements carefully.